Under its 2025 Strategy which was launched in August 2020, Chr. Hansen will continue its journey as a differentiated bioscience company with focus on microbial and fermentation technology platforms.

Компании Chr. Hansen и Novozymes объединили усилия и создали Novonesis – ведущего партнера в сфере биорешений. В тесном сотрудничестве с нашими клиентами мы трансформируем производство и потребление во всем мире.

Under its 2025 Strategy which was launched in August 2020, Chr. Hansen will continue its journey as a differentiated bioscience company with focus on microbial and fermentation technology platforms.

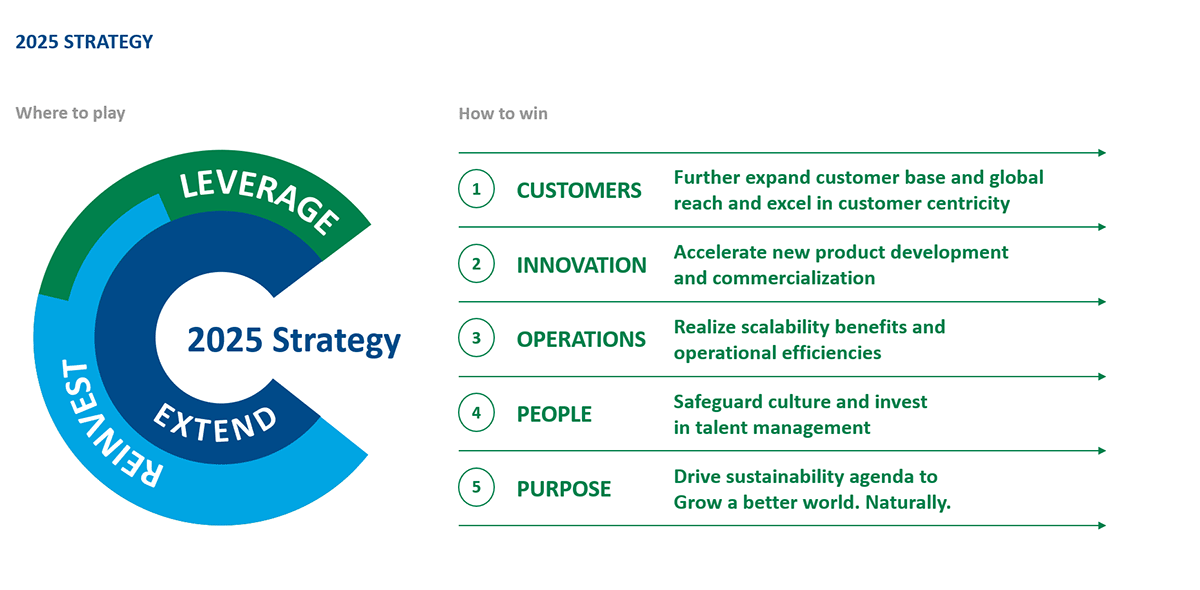

Chr. Hansen’s 2025 Strategy is based on three pillars that set the framework for its future growth trajectory: REINVEST, LEVERAGE and EXTEND.

REINVEST in core platforms

Chr. Hansen has been the ingredient supplier of choice for the dairy industry for many decades and has also built a strong microbial business for animal feed, dietary supplements and infant formula over the last thirty years. During the strategy period the majority of the absolute growth will come from the core platforms. As such Chr. Hansen will continue to prioritize and invest in Food Cultures & Enzymes, Animal and Human Health. Innovative products, launched across all business areas, are expected in the strategy period, both in existing and new product categories, for example probiotic solutions for foods and pet food.

LEVERAGE the Microbial Platform to grow lighthouses and new areas

Chr. Hansen continues to see many attractive growth opportunities to leverage its technology platform to develop solutions for new applications and end markets. The Company remains committed to further develop its five lighthouses which are new business area of strategic importance with minimum revenue potential of EUR 100m per year and above Group growth rates.

EXTEND Microbial Platform through M&A and R&D partnerships

During the strategy period Chr. Hansen intends to further strengthen its technology platform across its competencies, such as cultures and probiotics, dairy enzymes and value-added fermentation through acquisitions and the expansion of the R&D partner network.

Chr. Hansen has defined five dimensions along which the Company is going to implement the strategy: