Good results across business areas and regions secure upwards narrowing of full-year guidance. Extraordinary dividend announced for pay-out in May.

Continued strong organic growth momentum leads to upwards narrowing of full-year organic growth guidance.

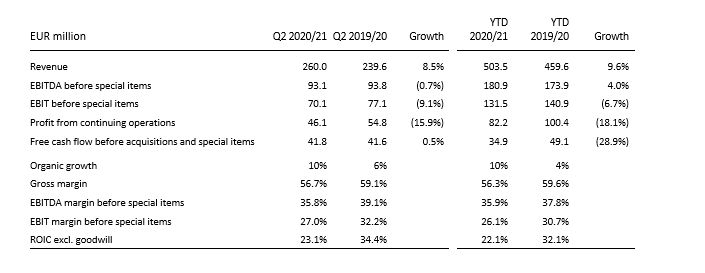

- Q2 2020/21 organic sales growth was 10%, equally split between volume/mix and price, and driven by Health & Nutrition which delivered 14% growth while Food Cultures & Enzymes delivered 8% growth

- Underlying EBIT margin b.s.i.1) of 30.9%, incl. >1%-point negative currency impact, compared to 32.2% in Q2 2019/20. Reported EBIT margin b.s.i. (incl. all acquisition impacts) was 27.0%

- Integration of commercial activities in UAS/HSO is completed and integration of manufacturing is progressing

- HMO capacity expansion in Germany on track, while delays in product registrations and regulatory approvals remain a constraint on market development; the market opportunity long-term is unchanged

- Full-year outlook for organic growth adjusted to 6-8% (previously 5-8%), free cash flow narrowed upwards to EUR 140-160 million, EBIT margin guidance unchanged, and impacts from acquisitions also unchanged from Q1

CEO Mauricio Graber says: “In our second quarter we delivered strong organic growth on a more demanding comparable from last year, with continued good momentum in both business areas. Our business in Asia-Pacific delivered 10% organic growth fueled by Health & Nutrition, providing reassurance that we can grow the region strongly even as the Chinese yogurt market is still in decline. Customer engagement, both in China and globally, remains high despite the current difficulties of in person interactions.

Through the acquisitions we have done, we are building a more balanced business globally between Food Cultures & Enzymes and Health & Nutrition. We’ve continued the integration of the acquired businesses and have recently completed a major milestone in the divestment of Natural Colors, and we are executing our strategy of becoming a focused bioscience company based on a unique microbial and fermentation technology platform.

Following the divestment of Natural Colors, we have initiated the process for paying out an extraordinary dividend of around EUR 116 million, and payment of the dividend is expected to be effected during the month of May.

In Q2 we progressed on our innovation agenda with many new patents, trademarks and registrations, and in Q3 we will be launching the next generation of bioprotection for fermented milks and certain cheeses.

As a result of the strong organic growth in the first half of 2020/21, and despite the uncertainties lingering from COVID-19, we have narrowed upwards our full-year outlook for organic growth, and we expect that Q4 to be the stronger of the two remaining quarters, primarily as Q3 of last year had a tailwind effect from customers building COVID-19 related safety inventories.”

Outlook for 2020/21

Organic revenue growth | 6-8% |

EBIT margin before special items | 27-28% |

Free cash flow before special items, acquisitions and divestments | EUR 140-160 million |

The guidance for EBIT margin before special items and for free cash flow before acquisitions and special items assumes constant currencies from the time of this announcement and for the remainder of the financial year.

科 汉森是一家全球性且具备差异化的生物科技公司,为食品行业、营养行业、制药行业和畜牧业开发天然原料的解决方案。 在科 汉森,我们拥有独特的优势,可通过微生物解决方案推动积极的变革。 在过去超过 150 年的时间里,我们致力于实现可持续的农业、更好的食品以及让全世界更多的人过上更健康的生活。 我们的微生物和发酵技术平台拥有改变规则的潜力,库存广泛且价值重大,包括约 50,000 种微生物菌株。 除了适应客户需求和全球趋势外,我们还将挖掘释放有益菌的力量,以应对食物浪费、全球健康以及抗生素和杀虫剂滥用等全球挑战。 作为全世界最具可持续性的生物技术公司,我们每天影响超过 10 亿人的生活。 受我们的创新传统与对前沿科学的求知驱动,公司宗旨“To grow a better world. Naturally.”体现在我们的所有工作中。