Chr. Hansen is a global, differentiated bioscience company headquartered in Hørsholm, Denmark, that develops and produces microbial solutions for the food and beverages, nutritional, pharmaceutical and agricultural industries. The Company sells its products in more than 140 countries and has 3,700 employees.

Chr. Hansen was founded in 1874 by the Danish pharmacist Christian D. A. Hansen who invented an industrial process to extract rennet for cheese making and has since then developed into a microbial powerhouse.

The Company is listed on the Nasdaq Copenhagen stock exchange via its holding company Chr. Hansen Holding A/S whose sole activity is managing the Chr. Hansen Group.

Organizational structure

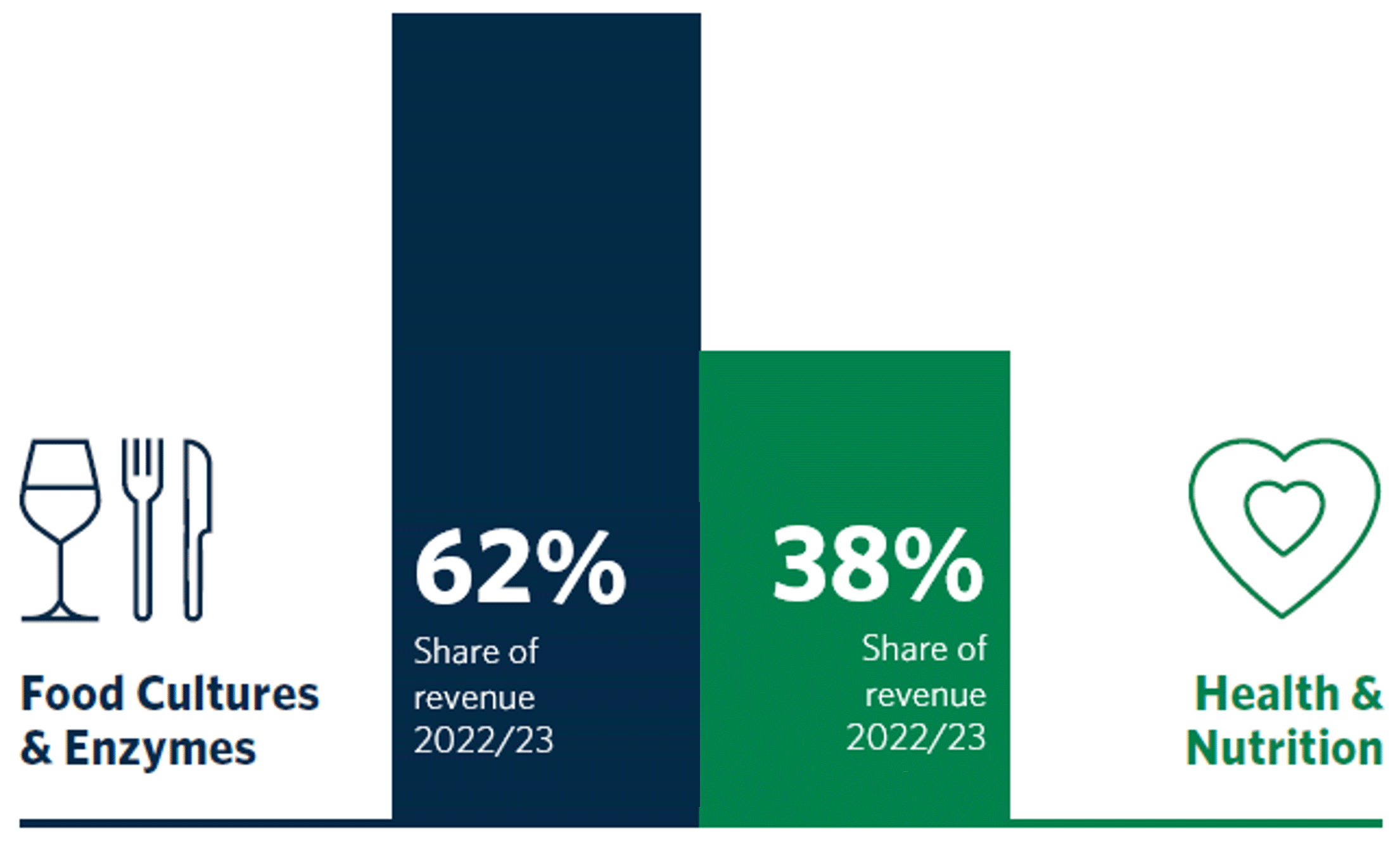

Organizationally, Chr. Hansen is split into two segments, Food Cultures & Enzymes and Health & Nutrition. Food Cultures & Enzymes comprises our dairy and food and beverages activities. Health & Nutrition comprises four business units: Human Health, Animal Health, Plant Health and Human Milk Oligosaccharides (HMO).

Chr. Hansen’s Natural Colors division was divested to the Nordic private equity group EQT in March 2021 and no longer forms part of the Group.

Position within value chain and key markets

As a specialty ingredient supplier, Chr. Hansen exclusively operates as a business-to-business company. While our microbial solutions usually make up only a small part of a product’s cost base, they are strategically important for our customers as they can:

- define and differentiate the end product

- support health and well-being

- increase productivity and yield

- extend shelf life and increase food safety

- contribute to reducing antibiotic usage

- offer an alternative to chemicals.

The risk of substitution in the Food Cultures & Enzymes core business is very low, given that cultures and enzymes are indispensable ingredients in yogurt and for cheesemakers. In Health & Nutrition and our lighthouses, the substitution risk is higher, as our products compete with alternative technologies or non-usage. As such, adoption is more dependent on customers’ willingness to innovate and embrace new technologies.

Competitive landscape

Generating EUR 1,334m revenue in 2022/23, Chr. Hansen is the world’s largest food cultures and dairy enzymes producer and a leading manufacturer of probiotics and HMOs.

Chr. Hansen operates in several niche markets with different competitive dynamics. Market concentration is the highest in Food Cultures & Enzymes, with the top three players combined accounting for most of the global market. The competitive landscape is relatively stable, and no meaningful new entrants have emerged over the past decade. In Health & Nutrition, competition is more diverse and dynamic given the relatively larger market opportunity. That said, Chr. Hansen holds leading positions in all its segments except for Plant Health.

Significant features of legal, regulatory and macroeconomic environment

External factors such as economic growth, consumer income or commodity prices impact our businesses to varying degrees. Purchasing power, for example, is an important indicator for discretionary product categories such as probiotics and HMOs or regional markets where dairy is not a food staple. Commodity prices, on the other hand, that drive farmer economics in the agricultural industry such as raw milk, livestock or feed prices can impact purchase decisions for our Animal and Plant Health products.

The regulatory environment depends on the targeted application and country of destination. In most jurisdictions, Chr. Hansen’s products are subject to general food law and food safety regulations. While requirements for substantiating the safety and efficacy of ingredients are converging, regulatory approval and product registration timelines for some industries, e.g. agricultural solutions, can be quite a lengthy process despite regulators’ efforts to support technologies that contribute to more sustainable development like the EU Green Deal. Complexity and lack of harmonization presents another challenge, particularly for our probiotics business where health claim labeling varies considerably between regions.

How we create value

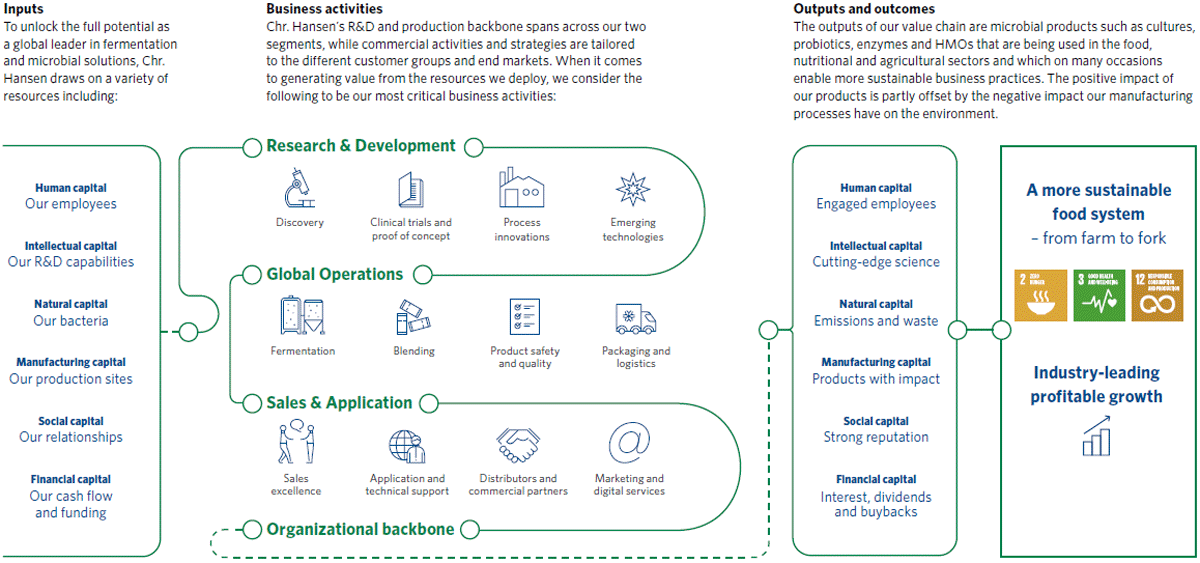

Chr. Hansen’s business model is centered around our unique fermentation and microbial technology platforms backed by nearly 150 years of experience, a scalable production set-up as well as long-standing relationships with customers – all of which together puts us in a very strong competitive position.

Illustration from the Annual Report 2021/22. Click to enhance.

To unlock its full potential as a global leader in fermentation and microbial solutions, Chr. Hansen draws on a variety of resources including:

- Human capital: A highly skilled and diverse workforce

- Intellectual capital: A strong R&D engine and intellectual property

- Natural capital: Access to nature´s microbial diversity via our culture collection of about 50,000 strains and natural resources such as energy and water

- Manufacturing capital: Best-in-class fermentation facilities and a global network of application centers

- Social capital: Close collaboration with customers, regulators, industry associations, academia and other stakeholders

Financial capital: Strong internal cash flows and access to external funding.

Chr. Hansen’s R&D and production backbone spans across Food Cultures & Enzymes and Health & Nutrition, while commercial activities and strategies are tailored to the different customer groups and end markets. When it comes to generating value from the resources we deploy, we consider the following to be our most critical business activities:

- Research & Development: Pioneer microbial science to develop new products that meet customer needs

- Global Operations: Secure production capacity and drive efficiencies to unlock fuel for growth while minimizing our environmental footprint

- Sales & Application: Excel in customer centricity with superior product offering, best-in-class technical support and local presence

- Human Resources: Invest in talent and diversity

- Finance: Ensure efficient capital and resource allocation to support strategic agenda

- Stakeholder Engagement: Engage in partnerships and advocacy to promote the adoption of microbial solutions.

To read more about our business activities, please refer to the Annual Report 2021/22 pp. 17-27.